Electric Car Trends

- Chris Jernstrom

- Jun 25, 2019

- 5 min read

Introduction

Over the past two decades, the world has seen expanded research, development, and growth in the electrification of automobiles. From early hybrid battery cars such as the Toyota Prius to the fully electric Tesla Model 3, the industry has moved from niche to mainstream. As more manufacturers begin to offer fully electric models, what impact does this have on the auto industry and how should investors respond?

This investor letter will share the history of electric vehicles, current and projected growth, and investment considerations for those interested in the electric vehicle industry.

History of Electric Vehicles

Electric cars were first developed in the late 19th century [1]; however, their adoption was limited as developments in the internal combustion engine quickly led to the popularity of the traditional gas- and diesel-powered automobiles we commonly use today. In the early 1990s and in response to air quality regulations, major manufacturers began developing alternative low-emissions models such as the Toyota RAV4 EV and GM EV1.

These pioneering electric vehicles were costly to manufacture and had limited consumer adoption; subsequent improvement in battery technology and consumer demand for better fuel efficiency led to the early hybrid vehicle development in the early 2000s. Hybrid vehicles combine an internal combustion engine with a battery-powered electric motor. Popular hybrids, such as the Toyota Prius and Honda Insight were met with broad consumer acceptance and impressive vehicles sales as evidenced by over 6 million vehicle sold worldwide of the Prius since inception [2].

Upon the initial success of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), traditional manufacturers like Nissan and new entrants like Tesla began to develop fully electric vehicles which relied solely on battery power (BEVs). With the development of the Tesla Roadster in 2008, the Nissan Leaf in 2010, and the Tesla Model S in 2012, a broadening line-up of fully electric vehicles began to be commercially available for U.S. and global consumers.

Today, continued growth in consumer demand and the sales success of vehicle manufacturers, such as Tesla, has led to a sharp increase in the number of fully electric models available in showrooms today. Traditional manufacturers such as Audi, Ford, Hyundai, Jaguar, GM, BMW, and Kia all now offer fully electric models.

Current State + Projections

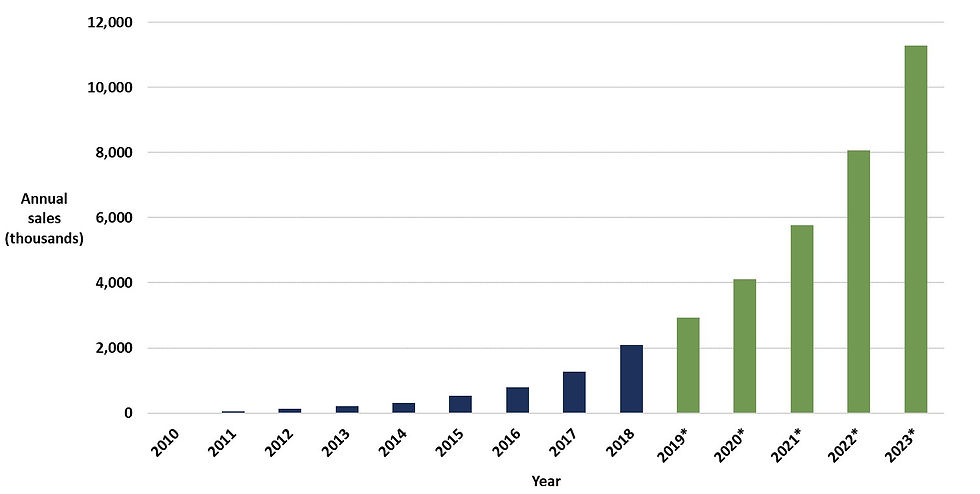

While Tesla and other major manufacturers have begun offering a wide array of plug-in hybrid and fully electric vehicles (EVs), mass adoption still remains limited with only EVs only accounting for 2.2% of global vehicle sales in 2018[3]. While EVs only account for a small amount of global vehicle sales, the segment is growing rapidly, with global sales up 64% in 2018.

Surprising to many Americans, the United States only accounts for 17% of global plug-in sales. China is the main driver of sales with over half of global sales, followed by the U.S. and Norway.

While current EV sales remain small relative to total vehicle sales, their high level of growth will continue to expand their share of the total vehicle market. This sales growth has led to the creation of new EV-only companies, such as Rivian, which has raised capital from Amazon and Ford and plans to offer a fully electric truck and SUV starting in 2021. Consumer acceptance, lower battery costs, and increasing regulation of vehicle emissions globally will help fuel sales growth trend into the future. We estimate EVs sales will continue to experience an annual growth rate of 40% and account for almost 15% of total vehicle sales by 2023.

Investment Considerations

When considering the electric vehicle industry for investment, there are a number of different ways of gaining exposure to the industry’s growth. Most common is looking at EV-only manufacturers, such as Tesla, or other traditional manufacturers with EV models, such as GM, Ford, and Nissan.

However, outside of companies involved in the direct manufacture of EVs, new industries are being created to support the EV supply chain including battery manufacturers, such as Panasonic, who is the primary battery supplier to Tesla, as well as power management systems and specialized components.

The growth of EVs is also creating brand new industries, such as charging infrastructure and battery recycling. Nissan, for example, is expecting the batteries in their Leaf model to outlast the life of their vehicles and is working on ways to re-purpose the batteries into other uses, such as battery storage for solar panels and usage in RVs.[4]

Outside of consumer EVs, investors are also looking at the impact of improved battery technology (lower cost, lighter weight) on cargo transportation, such as semi-trucks. Manufacturers such as Tesla, Freightliner, and Cummins all have electric semis in development which could expand the demand for EV support industries and lead towards quicker adoption of EV technology in other industries. As EV technology develops and operating costs continue to drop, we expect further expansion into other industrial applications.

Lastly, for investors interested in solutions to reduce carbon emissions from transportation, EVs will play an important role. However, the promise of a carbon-free future through EVs will have to overcome the current environmental and social challenges associated with battery production. The raw materials used in battery production, including lithium, nickel, and cobalt, have historically had labor rights and safety issues in their mineral extraction. Amnesty International has raised causes of concern in the cobalt supply chain in the Democratic Republic of Congo, including child labor[5]. Several car manufacturers and battery producers are responding to these concerns and have made progress in reducing the amount of cobalt used in their battery formulas.

Conclusion

It is clear electric vehicles are changing the landscape of personal transportation. In less than two decades, EVs have developed from a niche industry to one projected to account for 15% of global auto sales in less than five years.

As battery technology continues to develop, we expect an expansion of EVs to other segments of the transportation sector, including trucking. EVs coupled with autonomous driving could change the entire dynamic of the transportation sector as we know it today. This shift will take time and there will be companies who are able to navigate the shift and those who are not. Ironstream continues to look closely at the EV industry to understand the impacts on companies we own in client portfolios and find new companies who will benefit from the long-term trends.

[1] “Timeline: History of the Electric Car,” https://www.energy.gov/timeline/timeline-history-electric-car

[2] “Worldwide Sales of Toyota Hybrids Surpass 10 Million Units,” https://newsroom.toyota.eu/global-sales-of-toyota-hybrids-reach-10-million/

[3] “Global EV Sales for 2018 – Final Results,” http://www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes/

[4] “Nissan Leaf batteries are lasting a very long time,” https://www.greencarreports.com/news/1123670_nissan-leaf-batteries-are-lasting-a-very-long-time

[5] “Amnesty challenges industry leaders to clean up their batteries,” https://www.amnesty.org/en/latest/news/2019/03/amnesty-challenges-industry-leaders-to-clean-up-their-batteries/

Ironstream Capital, LLC is a registered investment adviser in the State of Washington and the State of Alaska. Ironstream Capital, LLC may not transact business in states where it is not appropriately registered, excluded, or exempted from registration. Individualized responses to persons which involve either the effecting of transaction in securities or the rendering of personalized investment advice for compensation, will not be made without registration or exemption.

The views presented are as of the date published. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell, or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to change at any time due to changes in market or economic conditions. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Is it not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Comments